Your credit score is the most important factor when you are applying for a loan, a lease or a mortgage. This is why you should always try to keep your credit score as high as possible, practice good spending habits, and use credit responsibly. If your credit score isn’t high enough to get the financing you need, you can boost your credit score with Tradeline Club.

What is a good credit score?

Most credit experts consider a credit score of 650 to be fair. This credit score could mean that you have successfully paid most of your bills to your creditors but you might have missed a few payments along the way. It might also mean that you do not have much of a credit history and that you may not have utilized credit in the past.

Most credit experts consider a credit score of 650 to be fair. This credit score could mean that you have successfully paid most of your bills to your creditors but you might have missed a few payments along the way. It might also mean that you do not have much of a credit history and that you may not have utilized credit in the past.

When a bank or lending service looks at your credit score and it’s in the 650 range, you will most likely be rejected when you apply for financing. This is not always the case, of course. Some more liberal institutions might consider giving you a loan, but with worse conditions. If you are approved you will almost definitely get a higher interest rate, which means you will end up paying way more money than you would if your credit score was higher.

It is definitely worth boosting your credit before you apply for a new loan if your credit score is around or below 650. An improvement in your credit score means an improvement in the terms of your loan agreement, and that means more money in your pocket.

What will a hundred points change?

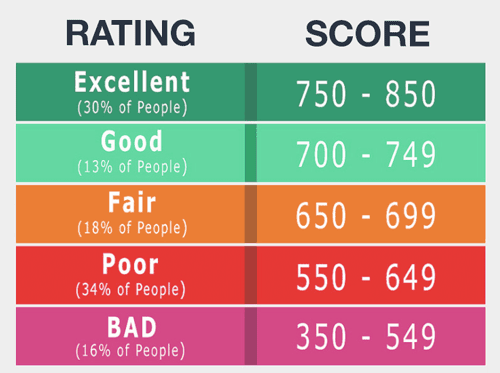

Using the 650 credit score as an example, a boost from the right tradeline could increase the credit score to approximately 750 points, which is a significant improvement. A credit score of 750 is higher than the national average in the US and offers you better loan options, interest rates and flexibility.

Boosting your score by 100 points can move you into a whole different category in the eyes of lenders. A high credit score is a better signal to lenders that you have and will pay you bills, and the terms that lenders offer you will definitely improve.

If you start improving your credit score immediately, you could see the results of your efforts in as little as one month. Get started now.

What should you do to get these additional hundred points?

There are numerous ways in which you can improve your credit score. Start out with the basics by trying to always be on time with your credit card, rent/mortgage and loan payments. All of these will likely report to most if not all of the credit reporting bureaus. Regular, on time payments is one of the essential factors which determine your credit score. Other than regular payments, you should make sure you have disputed any inaccurate credit history that you may have on your credit report. Sometimes payments can take a while to be recorded on your credit report. There is even a chance that some of them might not get registered by mistake, which is why you should always keep track and monitor your credit score.

There are numerous ways in which you can improve your credit score. Start out with the basics by trying to always be on time with your credit card, rent/mortgage and loan payments. All of these will likely report to most if not all of the credit reporting bureaus. Regular, on time payments is one of the essential factors which determine your credit score. Other than regular payments, you should make sure you have disputed any inaccurate credit history that you may have on your credit report. Sometimes payments can take a while to be recorded on your credit report. There is even a chance that some of them might not get registered by mistake, which is why you should always keep track and monitor your credit score.

Last but not least, you can always ask the experts at Tradeline Club to to answer any questions you may have about boosting your credit score or options for credit repair. Our team can create a plan to increase your credit score and help you achieve your goals. We can offer advice on the kinds of loans that may best suit your individual situation. Consider boosting your score before applying for any financing.